virginia hybrid tax credit

Virginia Tax Credits Review the credits below to see what you may be able to deduct from the tax you owe. Beginning January 1 2022 a resident of the.

Every Electric Vehicle Tax Credit Rebate Available By State

If you live in either Arlington or Loudoun County you may qualify for.

. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Virginia offers a number of credits for individual income tax filers.

Federal Tax Credit Up To 7500. To begin the federal government is offering several tax incentives for drivers of EVs. The PTC provides a corporate tax credit of 12 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and.

1500 towards the purchase or lease of a new plug-in hybrid electric vehicle or battery electric vehicle with a battery capacity of less than 10 kWh. They can add plug-in hybrids fleet vehicles and. Reference Virginia Code 332-501 and 462-7493 Green Jobs Tax Credit Qualified employers are eligible for a 500 tax credit for each new green job created that offers a salary of at least.

Federal Tax Incentives for Buying a Fuel-Efficient Car To entice American taxpayers to go green the government offers numerous federal tax. Federal Tax Credit Up To 7500. Alternative Fuel and Hybrid Electric Vehicle HEV Emissions Testing Exemption Idle Reduction and Alternative Fuel Vehicle Weight Exemption Alternative Fuel Tax Exemption UtilityPrivate.

While the Governors final amendments to the transportation bill are welcome and the reduction in the hybrid fee from 100 to 64 is certainly an improvement this new annual 64 registration. What You Need to Know About the 2022 One-Time Tax Rebate. If you take home a new PEV that meets.

Reid D-32nd would have granted a state-tax rebate of up to 3500 to buyers of plug-in electric cars. In the fall eligible taxpayers will receive a one-time rebate of up to 250 for individuals and up to 500 for joint filers. Refer to Virginia Code 581-2250 for specifics.

The credit amount will. In its final form the program which would begin Jan. An enhanced rebate of 2000 would also.

In addition to credits Virginia offers a number of deductions and subtractions from. A bill proposed in mid-January by Virginia House Delegate David A. Getty Starting on Jan.

1 2023 people who purchase eligible electric vehicles can receive 2500 to 7500 in tax. Ad Virginia hybrid tax credit. All credits have specific eligibility requirements and some require pre-approval or other certification.

The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. The newly restored EV tax credit does include some hybrid vehicles. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

Effective October 1 2021 until January 1 2027 Eligibility for rebate. The Commonwealth of Virginia provides several incentives for drivers of EVs to take advantage of. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles.

750 towards the purchase or lease of a. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. 2021 Virginia EV rebate bill HB 1979 proposes incentive for individuals who buy or leases an electric vehicle from a dealer in Virginia.

The credit amount will.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Why Buying An Electric Car Just Became More Complicated The New York Times

2022 Ev Tax Incentives And Benefits In Virginia Pohanka Acura

Federal Tax Credit Is Ford Mustang Mach E S Main Sales Argument Over Teslas

Ev Tax Credit Renewal And Expansion Gets First Big Push Under Biden Administration Cnet

Is There A Virginia Electric Vehicle Tax Credit Mini Of Sterling

Irs Clean Energy Tax Credits Electric Vehicles Irc 30d

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Virginia State Tax Rebate Up To 3 500 For Electric Car Purchase Dies In Subcommittee

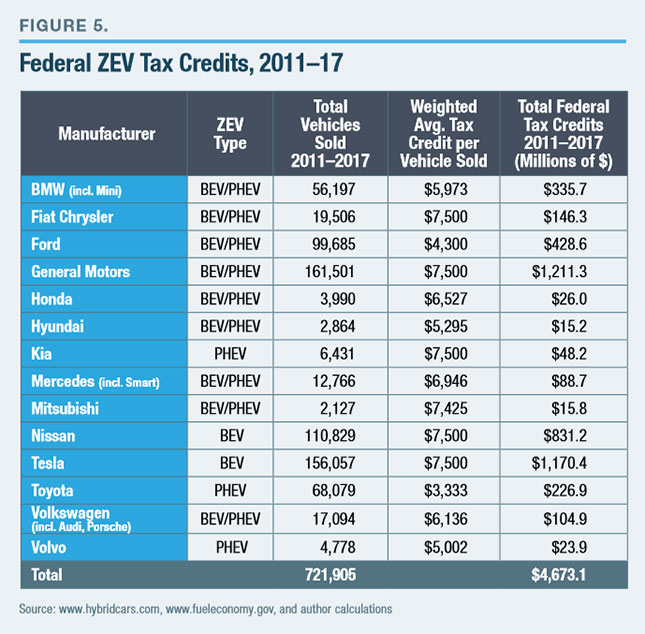

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

Incentives And Rebates For Residential Energy Efficiency Improvements In Virginia Local Energy Alliance Program

Virginia Vehicle Sales Tax Fees Calculator

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Money For Electric Vehicle Rebates Appears Unlikely Virginia Mercury

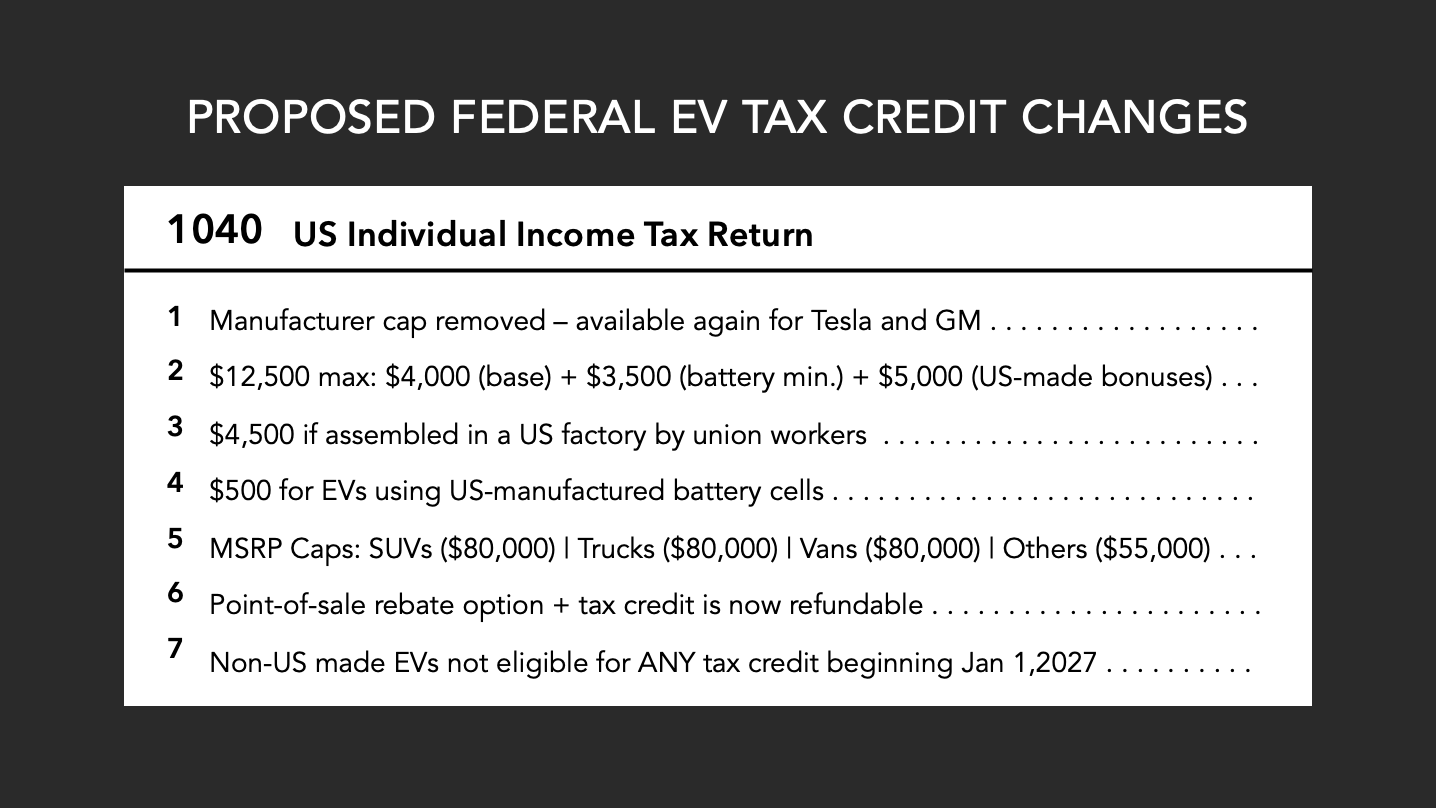

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post